The past few days brought three signals that matter for anyone planning, funding, or supplying high-power charging. First, U.S. federal guidance for the NEVI program was reissued in an interim final form designed to streamline state implementation. Second, California opened a new statewide incentive window that can cover up to the full installed cost of ready-to-build DC fast-charging sites. Third, European data updates show the network continuing to scale after passing the one-million-charger mark in 2024. Together, these point to a second half of 2025 that prioritizes faster deployment and higher operational reliability.

Why the federal signal matters in the U.S.

FHWA’s interim final guidance for NEVI took effect on August 13, 2025, while inviting public comment. The intent, in DOT’s summary, is to streamline requirements and give states more flexibility in how they write plans and move projects forward. For developers and suppliers, that reduces ambiguity in timelines and should help convert backlogs into energized sites. If states respond by simplifying procurement and approvals, expect steadier order flow into Q4.

California just made ROI easier to pencil

On August 5, the California Energy Commission opened applications for the Fast Charge California Project, with at least $55 million available. The window runs from August 5 to October 29, 2025, and prioritizes ready-to-build projects—those with final utility service design and issued permits in hand. Incentives can cover up to 100% of eligible costs, capped at $55,000 per port for 150–274.99 kW and $100,000 per port for 275 kW and above. Notably, J3400 connectors are eligible, but each site must still install at least 50% CCS connectors. These design details will influence hardware mixes and cable/handle specifications at the site level.

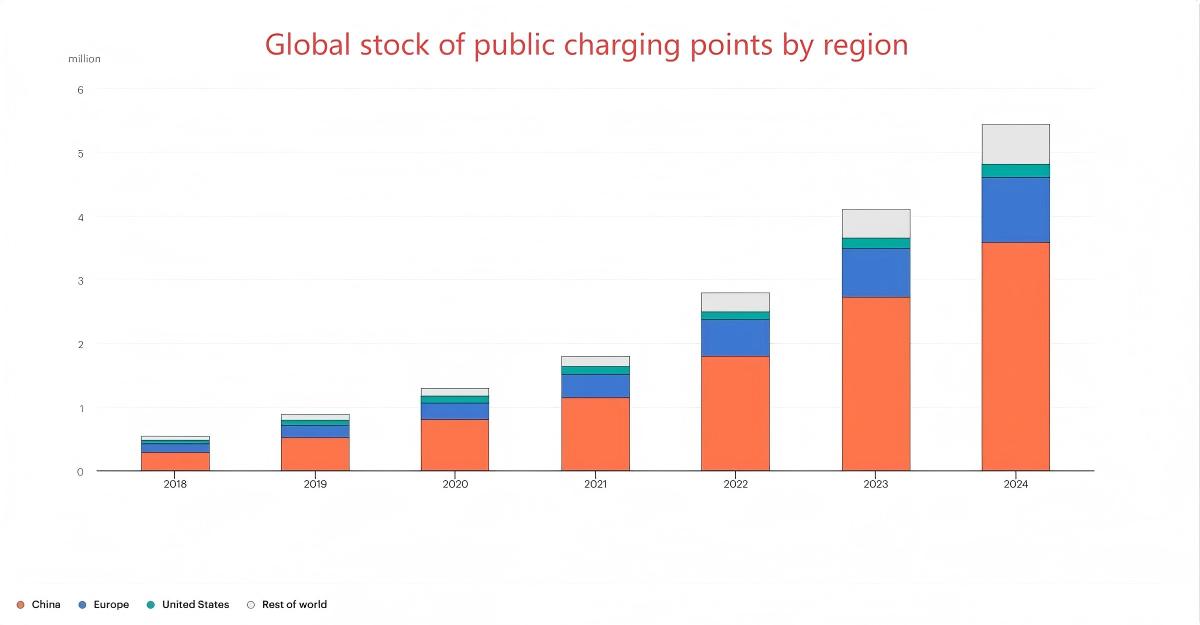

Europe’s map keeps filling in—especially at higher power

IEA’s 2025 outlook shows Europe grew public charging points by more than 35% year-over-year in 2024, surpassing one million. The EU’s AFIR requirement—150 kW stations every 60 km on core corridors by 2025, with power minimums rising by 2027—continues to push high-power builds, while EAFO’s mid-August data update confirms ongoing additions across member states. For cross-border fleets and highway sites, that means more consistency in connector standards, power levels, and driver experience—raising the stakes for uptime and serviceability.

From getting built to staying available

Scale is no longer the only story. As networks densify, what differentiates sites is how well they operate in heat, cold, salt spray, and holiday peaks. Three practical areas deserve attention:

• Thermal and contact performance. High current over long sessions amplifies any weakness in contact resistance and heat dissipation. Selecting handles and cable assemblies that keep surface temperature comfortable and minimize resistive losses under sustained load will pay back in user experience and lower derating events.

• Real-world ingress protection. Lab ratings matter, but so do the details: performance when the plug is mated versus unmated, behavior under high-pressure jets versus immersion, and how holsters and caps keep grit and water out between sessions. Pairing the right IP strategy with matched storage hardware reduces contamination that drives early failures.

• Field serviceability by design. Swappable wear parts, clear torque specs, and defined toolkits cut mean time to repair. Writing these expectations into the site’s operations scope—along with spares and response SLAs—protects uptime during peak demand.

What this means for 2025 H2 procurement

United States: Expect some states to accelerate NEVI-related contracting under the streamlined guidance. Hardware that shortens installation and commissioning—clean utility interfaces, robust OCPP implementations, and proven commissioning workflows—will help projects meet the tighter funding windows.

California: The Fast Charge California rules create a strong pull for high-power, public-access DCFC where civil work and utility design are already complete. The 100%-cost coverage cap makes it feasible to upgrade to higher-power ports or add more stalls where dwell time is short. Given the connector rules, sites will likely standardize on CCS with selective J3400 to serve newer vehicles without sacrificing eligibility.

European Union: The combination of AFIR targets and the million-plus installed base is shifting attention from where to build to how to deliver consistent charging speeds and minimize queues. Specifying longer, durable cables for varied parking geometries, and choosing handles with proven ergonomics in rain and cold, will matter as much as nameplate power.

Where Workersbee fits

For buyers and integrators, the safest path is to pair power density with ruggedization and easy upkeep. That means DC handles and liquid-cooled or naturally cooled cable sets engineered for low thermal rise, tight ingress control in both mated and unmated states, and fast field swaps of high-wear components. Those are exactly the qualities Workersbee focuses on in connector and cable design, and they directly support the policy-driven build-out now underway.

Policy momentum is backstopping investment, state programs are rewarding ready-to-build projects, and Europe’s network keeps scaling at higher power. Sites that translate those tailwinds into reliable, comfortable charging—by sweating the details in connectors, cables, and serviceability—will win the next six months on both utilization and customer satisfaction.